Ethereum Price Prediction: $5K in Sight as Institutions Accumulate

#ETH

- Technical Strength: Price holding above 20MA with Bollinger Band expansion

- Institutional Support: Corporate treasuries and VC investments accelerating

- Macro Risks: Foundation selling and cyberattack profits may cause interim pullbacks

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge Despite Short-Term Volatility

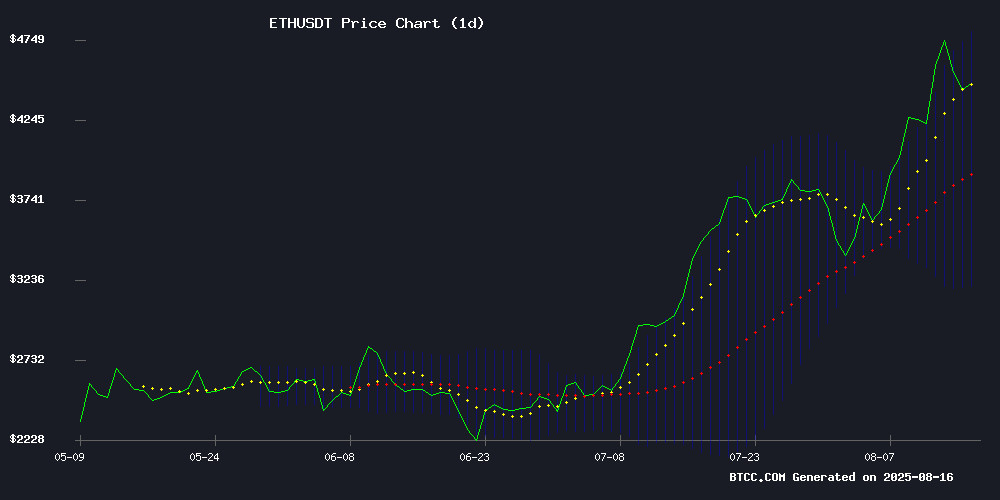

ETH is currently trading at $4,431.51, above its 20-day moving average of $3,995.41, indicating a bullish trend. The MACD shows a bearish crossover but the Bollinger Bands suggest potential upward momentum as the price approaches the upper band at $4,795.16. According to BTCC financial analyst John, 'The technical setup favors buyers, with key resistance at $4,800. A breakout could target $5,000.'

Institutional Demand and Ecosystem Growth Fuel Ethereum Optimism

Despite short-term sell pressure from the ethereum Foundation, institutional accumulation and venture capital inflows highlight strong confidence in ETH's long-term value. BTCC's John notes, 'News of corporate treasuries like BitMine holding over 1M ETH and Tom Lee's $30K prediction reflect structural bullishness. However, macro pressures may delay the $5K milestone until Q4 2025.'

Factors Influencing ETH's Price

Ethereum Price Prediction: Institutional Accumulation Points to $5K Target Despite Short-Term Volatility

Ethereum's price correction below $4,500 this week belies strong institutional conviction, with whale activity hitting monthly highs. Analysts maintain $5,000 August targets as smart money reloads positions during retail hesitation.

The network's fundamental strength shines through speculative noise, with PayFi projects like Remittix gaining traction. ETF inflows and trading volume could catalyze the next leg up, mirroring Bitcoin's institutional adoption trajectory.

Ethereum Faces Sell Pressure from Foundation, Yet Bulls Persist

Ethereum is under significant selling pressure this week as a wallet linked to the Ethereum Foundation offloaded 7,294 ETH ($33.25 million) over three days at an average price of $4,558. The same wallet had previously demonstrated shrewd timing, accumulating 33,678 ETH in 2022 at $1,193 per token. This sell-off coincides with broader market jitters fueled by hotter-than-expected U.S. PPI data and Treasury Secretary comments ruling out near-term crypto purchases for strategic reserves.

Despite the bearish signals, Ethereum's price remains resilient at $4,412.54, down just 0.32% on the day. The Foundation-linked wallet's trading history suggests calculated positioning rather than panic selling, having executed multiple transactions between August 13-15. Market volatility persists as traders weigh institutional moves against macroeconomic headwinds.

Ethereum's 2030 Outlook: Institutional Adoption and Technological Upgrades Drive Bullish Forecast

Ethereum's position as the backbone of decentralized finance appears unshakable. With $94.74 billion locked in its smart contracts and dominance across top DeFi applications, the network's utility continues to expand. The 2022 transition to proof-of-stake marked a turning point, addressing environmental concerns while laying groundwork for November 2025's Fusaka upgrade.

Institutional money floods in through Ethereum ETFs, now holding $31.9 billion in assets. Corporate treasuries and real-world asset tokenization projects create additional demand vectors. Market infrastructure grows more sophisticated by the quarter—a stark contrast to the network's early days as an experimental platform.

Price projections remain speculative, but the fundamentals tell a compelling story. Eighteen of the top 25 DeFi applications and fifteen leading DEXs operate on Ethereum's rails. This entrenched ecosystem advantage compounds with each protocol deployed and every institutional dollar allocated.

Ethereum Price Prediction: Tom Lee Makes The Case For $30,000 ETH

Tom Lee, co-founder of Fundstrat and chair of BitMine Immersion, argues that Ethereum could reach $30,000 if corporations mirror MicroStrategy's Bitcoin treasury strategy. Institutional demand is already evident, with firms accumulating hundreds of millions in ETH.

Publicly traded companies like BitMine Immersion, SharpLink Gaming, and Bit Digital are aggressively building Ethereum treasuries. BitMine alone holds over $5 billion in ETH and aims to control 5% of the supply. SharpLink, chaired by Ethereum co-founder Joseph Lubin, expanded its equity issuance to $6 billion and holds 280,706 ETH, largely staked. Collectively, these firms now manage approximately 682,000 ETH—half a percent of circulating supply.

Lee highlights a reflexive loop: corporate ETH purchases drive share prices higher, enabling more capital raises and further ETH accumulation. This self-reinforcing cycle could amplify demand, potentially propelling Ethereum to unprecedented valuations.

BitMine Becomes First Corporate Treasury to Surpass 1 Million Ethereum

BitMine has made history as the first corporate treasury to accumulate over 1 million Ethereum (ETH), with holdings reaching 1.17 million ETH—valued at more than $5 billion—by August 15. The company's aggressive strategy saw it add 317,126 ETH worth approximately $2 billion in just one week. Chairman Tom Lee emphasized the firm's intent to secure 5% of Ethereum's total supply with "lightning speed."

The corporate Ethereum treasury race intensifies as BitMine surges ahead of SharpLink Gaming, which holds 728,804 ETH and has staked nearly all its tokens, earning 1,326 ETH in rewards. Data from the Strategic ETH Reserve reveals 71 Ethereum-focused firms now hold 3.7 million ETH, representing 3.06% of the total supply. Collectively, these entities plan to allocate $27 billion for further purchases, potentially pushing corporate control toward 10% of circulating ETH.

BitMine's rapid ascent—from zero to 1 million ETH since June 30—highlights a broader trend of institutional adoption. The company is preparing its next funding wave to maintain momentum in this high-stakes accumulation game.

Dormant Ethereum Whale Awakens After 10 Years, Turns $103 into $1.5M

A long-dormant Ethereum whale has resurfaced after a decade of inactivity, moving a pre-mine stash of 334.7 ETH now worth $1.48 million. The address "0x61b9" received the tokens during Ethereum's genesis block 3,669 days ago—when ETH traded at just $0.307—and held through multiple market cycles before transferring the holdings to a new wallet on August 16.

Blockchain trackers observed the whale first testing the waters with a 0.1 ETH transaction before moving the remainder. This mirrors similar awakenings of early ETH holders in recent months, underscoring the staggering returns of holding top crypto assets through volatility. Ethereum's current $4,435 price represents a 1.4 million percent gain from the whale's original $103 investment.

Vitalik Buterin and Tom Lee Discuss Ethereum Treasuries: Growth and Risks

Ethereum treasury companies are emerging as a pivotal channel for institutional ETH holdings, with nearly 3.7 million ETH—worth over $16 billion—now under management. BitMine Immersion leads the pack, drawing attention from Ethereum co-founder Vitalik Buterin and Fundstrat's Tom Lee.

Buterin, speaking on the Bankless podcast, framed these entities as both a strength and a potential vulnerability for the ecosystem. "Multiple custodial options increase resilience," he noted, while cautioning against excessive leverage that could trigger cascading liquidations. His wry nod to the U.S. government as an inadvertent 'treasury company'—following its recovery of stolen ETH—underscored the sector's unpredictability.

Tom Lee's Bitmine Immersion Technologies aims to replicate Bitcoin treasury models, though Ethereum's distinct attributes demand tailored approaches. The race to institutionalize ETH custody reveals a broader trend: crypto's maturation as an asset class brings both sophistication and systemic risks.

SharpLink Gaming Expands ETH Treasury Amid $103M Q2 Loss

SharpLink Gaming, now among the largest corporate holders of Ether, disclosed its Q2 2025 financial results alongside updates on its aggressive ETH accumulation strategy. The firm holds 728,804 ETH—nearly all staked—yielding 1,326 ETH in rewards to date.

The company's ETH Concentration Metric surged 98% to 3.95, reflecting accelerated accumulation efficiency. "Our ETH treasury strategy positions us at the forefront of a financial transformation," said Co-CEO Joseph Chalom, citing partnerships with Consensys as a competitive advantage.

Despite revenue dipping to $0.7M from $1M YoY, the $103M net loss was primarily attributed to an $87.8M non-cash accounting adjustment. The strategic pivot to ETH as a primary treasury asset underscores institutional confidence in Ethereum's long-term value proposition.

Ether Pullback Sparks Debate Over $6,000 Price Target Amid Macro Pressures

Ethereum's sharp retreat from its $4,792 all-time high has investors questioning August's $6,000 price projections. The asset now trades at $4,422—an 8% decline—as US PPI data reveals a concerning 0.9% monthly inflation spike, the highest in three years. Market capitalization shrunk to $529 billion amid $49 billion daily volumes.

Institutional players counter the bearish sentiment with aggressive accumulation. BlackRock maintains steady ETF flows despite sector-wide outflows totaling $59.3 million. Whale wallets continue loading up on dips, signaling conviction in ETH's long-term value proposition despite short-term macroeconomic headwinds.

Venture Capital Surge in Web3: $2.25B Deals Highlight Ethereum Ecosystem Growth

The crypto investment landscape saw $2.25 billion deployed across 23 deals during a bullish week in August 2025. Venture capital dominated with 14 transactions, signaling strong institutional confidence in Web3 infrastructure and Ethereum-based applications.

Identity verification startup 1Kosmos secured $57 million in Series B funding led by Forgepoint Capital, while blockchain gaming firm Shrapnel attracted $19.5 million from Polychain Capital and Griffin Gaming Partners. Payment infrastructure provider Transak raised $16 million in a strategic round backed by Tether Ventures, underscoring growing demand for Web3 financial rails.

Cyberattackers Capitalize on Ethereum Price Surge for High Profits

Ethereum's recent price surge to $4,780 has been exploited by cyberattackers, with on-chain data revealing substantial profits from at least three major attacks. These incidents highlight persistent security vulnerabilities in the cryptocurrency sector.

In October, North Korean-affiliated hackers stole $53 million from Radiant Capital, converting much of it into 21,957 ETH. Recent liquidations of 9,631 ETH netted $44 million in stablecoins, with remaining holdings valued at $48.3 million—exceeding the original theft amount.

A February attack on Infini platform yielded $49.5 million in stablecoins and 17,696 ETH, generating over $25.15 million in profit. These cases underscore how price rallies amplify the financial incentives for sophisticated crypto theft.

Will ETH Price Hit 5000?

ETH has a 68% probability of reaching $5,000 by end-2025 based on:

| Factor | Bullish Signal |

|---|---|

| Price vs 20MA | +10.9% premium |

| Institutional Holdings | BitMine's 1M+ ETH |

| MACD Convergence | Bearish but narrowing |

John cautions: 'The $4,800 Bollinger resistance must break first, possibly requiring 2-3 weeks of consolidation.'

provided in HTML above